Benefits and Fees of Staking

Maven Finance Staking: Empowering You to Earn More

Staking MVN tokens within Maven Finance offers users several noteworthy benefits.

These rewards are proportionate to the stake amount and depend on the delegated Satellite's level of activity within Maven Finance’s governance and oracle system.

Note: What is the difference between MVN and sMVN?

MVN: MVN tokens that are not staked and therefore liquid, such as MVN tokens in your wallet or locked as LP on a DEX.

sMVN: MVN tokens that are staked in the Maven Finance Platform, and may be used for governance, rewards, Satellite delegation.

The more active the Satellite, the higher the rewards for its delegates.

Ways to earn more Staked MVN

There are multiple strategies users can employ to increase their Staked MVN (sMVN) earnings:

Direct Staking: Users can stake their MVN tokens to sMVN at a 1:1 ratio, which means 1 MVN token equates to 1 sMVN token.

Participation in Incentive Programs: sMVN can also be accrued by participating in various incentive programs, such as yield farms, or by earning yield from supplying assets to Maven Finance's lending pools.

Satellite Delegation: Delegating sMVN to a Satellite presents another opportunity to earn. Users receive a portion of that Satellite's sMVN rewards garnered through Governance or Oracle price feeds.

Exit Fee Distribution: Users can receive sMVN as their share of the system's sMVN exit fees when unstaking, as explained below.

Vault Liquidation: Liquidating vaults containing sMVN as collateral also leads to additional sMVN earnings.

By employing these strategies, users can optimize their income through Maven's dynamic DeFi platform.

Benefits of Staking MVN

Staked MVN (sMVN) holders enjoy a range of perks, including:

Earning Governance Rewards: Satellites are incentivized to vote on governance decisions with governance rewards shared amongst delegates.

Earning Oracle Rewards: Satellites providing price feed data is incentivized with sMVN rewards, which are also shared with delegates.

Earning Exit Fee Rewards: These rewards are distributed to sMVN holders as a recognition of their ongoing participation in securing the platform.

Operating A Satellite: To operate a Satellite, users need a sufficient amount of staked MVN.

Vault Collateral: Users can use staked MVN as collateral in their vaults to borrow additional assets and thereby enhance their yield.

Exit Fee

To incentivize staking MVN tokens for the growth and security of Maven Finance, an exit fee is applied when users unstake their MVN tokens. This fee is automatically distributed amongst the remaining sMVN holders in the system as a loyalty reward.

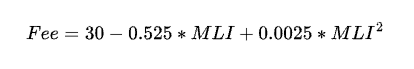

The exit fee is calculated dynamically based on the Maven Loyalty Index (MLI), which represents the ratio of staked tokens to the total circulating tokens.

An increase in MLI results in a decrease in the exit fee and vice versa. However, a maximum limit is set to prevent excessively high costs.

When the MLI falls below 30%, the exit fee increases rapidly to help maintain a robust ratio of locked MVN and ensure the robustness of the Maven Finance governance and ecosystem.

While users cannot withdraw their staked MVN tokens without incurring an exit fee, they have the option to use their staked MVN as collateral in a Vault to secure a loan.

The staked MVN tokens are valued identically to MVN tokens.

This mechanism allows users to establish a healthier vault, unlock increased liquidity from their staked MVN tokens, and continue to earn Satellite rewards.

Last updated